Amana Takaful Life Insurance (ATLI) has reported healthy growth in Y2021, steadily bouncing back from a relatively challenging period in 2020. In 2021, Amana Takaful Life also boosted its Gross Written Premium Contribution (GWP), and the organization’s convincing 2021 annual performance has been built on its winning Quarter-on-Quarter numbers throughout the year – including that of the 4th quarter of 2021 where it reported 163% net profit growth, and a steady 32% GWP growth, in comparison to Q4 2020.

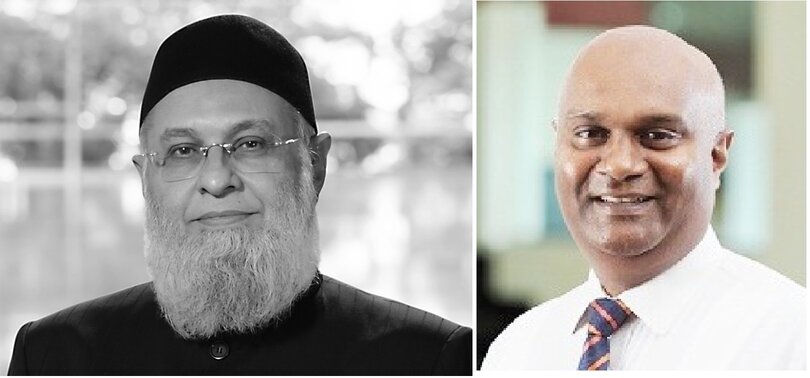

Chief Executive Officer, Gehan Rajapakse elaborates: “2021 was not an easy year in the insurance sector as it was a year where the Pandemic spread further while other unexpected economic challenges sprung up suddenly. As per our provisional reports, we braved these and recorded a winning fourth quarter which boosted our overall annual bottom-line of Y2021. To begin with, Amana Life Insurance recorded a healthy 128% YoY growth in its net profits in Y2021, overcoming the challenging position faced by the company over the past few years. Amana Life has recorded a double victory – not only did we witness a sharp turnaround, we also did it in the most economically challenging year in recent times. In 2021, ATLI also boosted its Gross Written Premium Contribution (GWP) by a steady 21% YoY, totalling at 881.7 Mn. Our overall growth has been well-aided by the significant 35% growth in our first-year regular business premium. During the year 2021, our total assets increased by 7.6% YoY to Rs 3.33 Bn. We also managed to expand our geographic foot-print through nearly 35 locations across Sri Lanka, covering all provinces.”

Commenting on the company’s success, the Chairman of Amana Takaful Life Insurance, Osman Kassim states: “A few years ago, Amana Takaful Life embarked on a refreshed strategic direction under new leadership with the objective of steering the organization towards a positive growth trajectory. In 2021, as a result of the significant turnaround that we have witnessed, I can now say that our plan has come to fruition. The successes of our 2021, I believe, are just the beginning of a long journey where the company expects to grow from strength to strength, not only financially but also in uplifting our product and service standards and in how we engage with all stakeholders. Let me also take a moment to congratulate the Amana Life team, for a successful 2021!”

About Amana Takaful Insurance:

Amana Takaful Life Insurance pioneered a unique concept of Insurance (Takaful) in Sri Lanka which is based on customer-centricity and ethical practices, and has today become a fully-fledged long-term insurance company in Sri Lanka. Amana Takaful Insurance was incorporated as a Public Company in 1999, and has been Listed on the Colombo Stock Exchange since 2006. Amana Life Insurance has expanded its geographic foot-print through 25+ branches across Sri Lanka, covering all provinces. Amana Takaful Insurance offers a complete range of Life and General insurance solutions as well as tailor-made health insurance policies to suit the overall health needs of diverse segments of society.

#ENDS#